How to Protect Against Check Fraud: Tips and Strategies

- Fred Vilensky

- Sep 11, 2024

- 2 min read

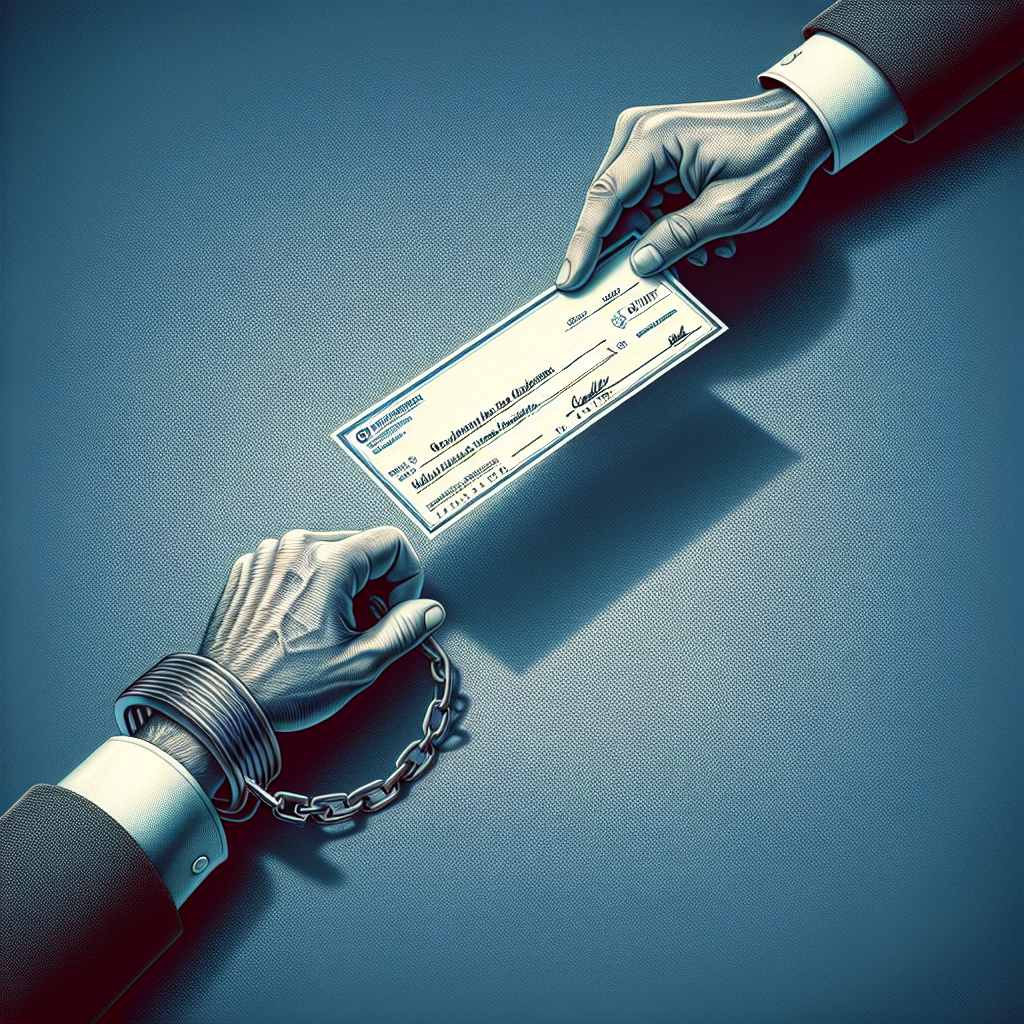

In today's digital age, where online transactions and e-commerce are prevalent, the risk of check fraud is still a prevalent threat. Check fraud, which includes practices like check washing and forgery, can lead to financial loss and damage to your financial reputation. To help you safeguard your finances and prevent falling victim to check fraud, we've compiled a list of common mistakes to avoid.

Verify the Recipient and Endorse Checks Carefully

One of the most effective ways to protect against check fraud is to be vigilant when writing checks. Always verify the identity of the recipient before issuing a check, ensuring that it is going to the intended party. Additionally, when receiving a check, confirm the authenticity of the endorsement and signature. Be cautious of any alterations or discrepancies that may indicate fraudulent activity.

Secure Your Checkbook and Account Information

Ensuring the security of your checkbook and account information is crucial in safeguarding against check fraud. Store your checks in a secure location and never leave them unattended. Furthermore, avoid sharing your account information or check details with unauthorized individuals. By maintaining control over your checkbook and account, you reduce the risk of unauthorized use by fraudsters.

Monitor Your Account Transactions Regularly

Monitoring your account transactions regularly is key to detecting any suspicious activity promptly. Keep track of your check payments, withdrawals, and deposits, and reconcile your statements diligently. If you notice any discrepancies or unfamiliar transactions, report them to your financial institution immediately. Timely action can prevent further fraud and mitigate potential losses.

Use Security Features and Technologies

To enhance the security of your checks and protect against alterations, consider using checks with security features such as watermarks, microprinting, or security threads. These features make it harder for fraudsters to tamper with or replicate your checks. Additionally, explore digital banking options, like electronic bill pay and online check monitoring, to track your check activity in real-time and prevent fraud proactively.

Educate Yourself and Stay Informed

Staying informed about the latest trends and methods used in check fraud is essential to protect yourself effectively. Educate yourself on common check fraud schemes, such as check washing, where the ink is chemically erased to alter the payee and amount. By knowing how fraudsters operate, you can identify red flags and implement preventive measures to safeguard your finances.

Conclusion

In conclusion, safeguarding against check fraud requires a combination of vigilance, security measures, and knowledge about fraudulent practices. By following the tips outlined in this guide and remaining proactive in monitoring your financial transactions, you can reduce the risk of falling victim to check fraud. Remember, prevention is key when it comes to protecting your finances from malicious intent. Stay alert, stay informed, and keep your checkbooks secure to mitigate the risks of check fraud successfully.

Comments